How to set up your Zetl Account

Setting up a Zetl account is as easy as 1, 2, 3… In this guide, we’ll walk you through the step-by-step process, so that you can receive funding with ease.

Setting up a Zetl account is as easy as 1, 2, 3… In this guide, we’ll walk you through the step-by-step process, so that you can receive funding with ease.

Step 1: Sign Up

If you’re a new user, we require some background information before we can start. This is a one-off process known as KYC (Know Your Customer) and is compulsory for all of our customers.

Zetl holds a money lender’s license, which is why we need to conduct background checks. This is to prevent illegal activities such as money laundering.

This step requires you to submit the following documentation:

- Historical data of client invoices and settlement dates

- 6 months of bank statements

- 3 years of financial statement

- Latest management accounts

- Business registration certificate

- Submission of your director’s KYC

As a new customer, this step in the onboarding process will usually take 3 to 5 days. However, if you have all the documents prepared, your account can be set up sooner.

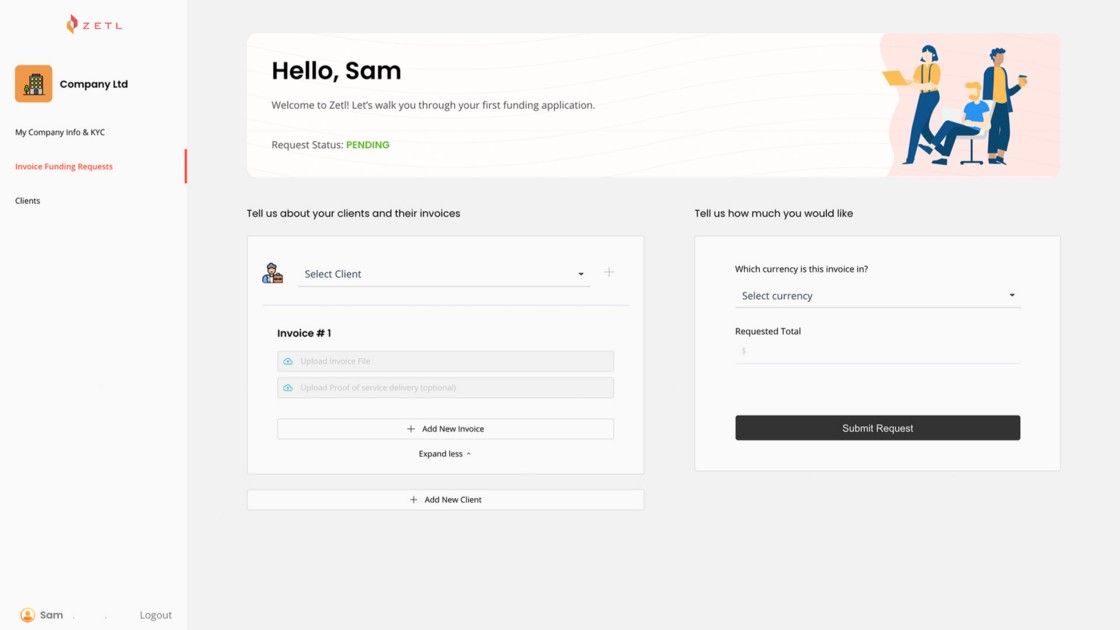

Step 2: Submit Invoice

In the second step, we require you to submit the invoice for which you would like to receive funding. If this is your first invoice from a new client, we require some basic information from the client as well.

We will never contact the client because we value your confidentiality. We do verify the documents to prevent fraud.

Step 3: Unlock Funds

Once we have done our due diligence and approved your request, you can sign digitally and receive your funds within 24 hours.

That’s it… Instead of waiting weeks for approval from a bank, you can now receive same-day funding for your business growth.