What does a healthy balance sheet look like?

The balance sheet is often described as invaluable, as it provides an accurate reflection of the company’s overall financial health and net worth. It does this by looking at a company’s assets, liabilities, and equity at a specific point in time.

Every company has a balance sheet. But what is it?

This article will explain the basics of balance sheets and how to interpret them.

What is a balance sheet?

Every business has three financial statements: the income statement, cash flow statement, and the balance sheet. The balance sheet is often described as invaluable, as it provides an accurate reflection of the company’s overall financial health and net worth. It does this by looking at a company’s assets, liabilities, and equity at a specific point in time.

The three components of a balance sheet are assets, liabilities, and equity. Assets are items of value that are owned by the business. Liabilities are what the business owns to creditors, such as third-party institutions like banks, while equity represents shareholder stakes in the company.

How does a balance sheet work?

Every balance sheet is based on the following formula:

Assets = Liabilities + Equity

When making a balance sheet, it’s important to ensure that each side of the equation is balanced — that is, they must be the same value. If they aren’t, it usually indicates that your accounting system is faulty, or there may be more serious issues at hand, such as cash flow problems.

The balance sheet also relates to the other two financial statements, the income statement and cash flow statement. While there are some similarities between the income statement and balance sheet, the balance sheet shows all the assets, liabilities and equity at a specific point in time, whereas the income statement looks at your expenses and revenues over a period of time.

Generally speaking, the income statement can be interpreted as a performative measure, while the balance sheet is a broader and more detailed summary of the financial position of the business overall.

The cash flow statement, just like its name suggests, shows cash inflows and outflows during a period of time. The assets and liabilities on the balance sheet are partly dependent on the movements in this.

Components of a balance sheet

Assets

Assets are usually recorded on the first column of the balance sheet. They can be classified as current and non-current assets. Current assets are usually assets that can be converted to cash within a year, while non-current assets are long-term assets that can take over a year (and many years in some cases) to realise their full value.

Examples of current assets include accounts receivable (the money owed by customers), your inventory, marketable securities and prepaid expenses. Non-current assets can include things like land, intellectual property, patents and goodwill.

Goodwill is what happens after two companies complete a merger or acquisition, and is what a company pays above and beyond the value of the other company’s assets. For example, if a company is sold for $100,000 and has $90,000 in assets and $10,000 in liabilities, goodwill is recorded as $20,000 (the value of assets is $80,000 after the removal of liabilities).

Since assets can be long-term, all balance sheets factor in depreciation. This is listed as an expense, and tracks the cumulative decrease in value for your assets from when they were acquired to the current point in time.

Liabilities

Liabilities are usually recorded on the second column of the balance sheet. Much like assets, they can also be classified into short-term liabilities (current liabilities) that can be paid within a year and long-term liabilities (non-current liabilities) that cannot be paid within a year.

Examples of current liabilities include rent, utilities, taxes and wages, while long-term liabilities include long-term debts and interest.

Equity

Equity is usually recorded under liabilities and is essentially the leftover value after your liabilities have been subtracted from your assets. This can include things like common stock, which is the ownership share in the company; and retained earnings, which is the leftover income of the business after dividends have been paid to the shareholders.

Preparing a balance sheet

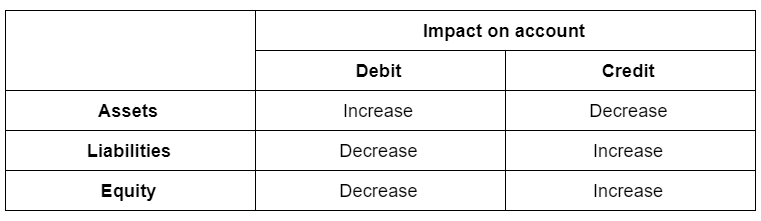

When preparing your balance sheet, you should be referencing journal entries, which are the records of the financial events that have happened. Journal entries are balanced: debits (what is owed) should always have a corresponding credit (what is received). The impact of debits and credits depend on if the account is an asset, liability or equity account.

There are two types of journal entries: adjusting and recurring. Adjusting journal entries typically apply to financial transactions that have not been recorded before during the year, such as the depreciation expense. On the other hand, recurring journal entries are transactions that occur periodically, such as monthly or quarterly, such as payroll expenses. Your accounting software will usually record some transactions like customer invoices, meaning that you don’t need to write journal entries for every transaction.

What does a balance sheet look like?

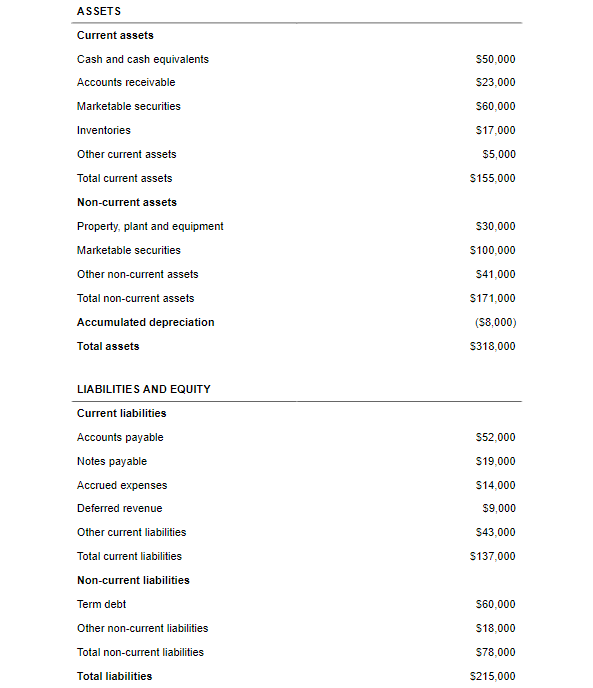

An example of a balance sheet is as follows:

As noted previously, total assets should be equal to total liabilities and equity, which is $318,000 in this case. Depreciation is also noted as an expense under assets, as assets can decrease in value over time, so we subtract it from the total asset value.

Evaluating a balance sheet

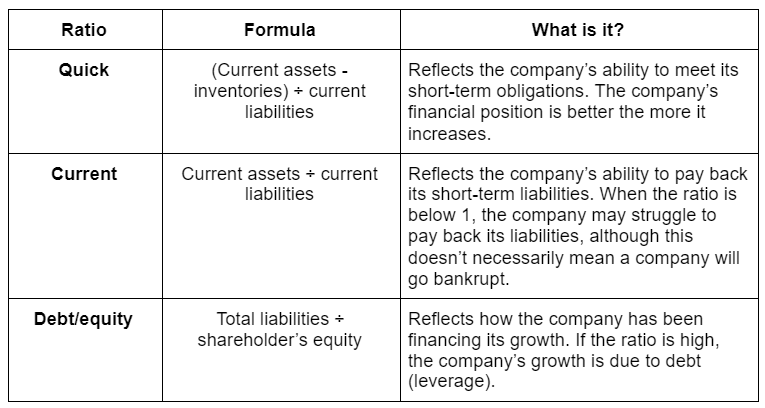

The balance sheet reveals a lot about a company’s position. Usually, this is reflected through balance sheet ratios. Some common ratios include the quick ratio, current ratio and debt/equity ratio.

There are many other ratios that can be determined from the balance sheet, but the quick, current and debt/equity ratios provide a general overview of the company.

Conclusion

The balance sheet shows a company’s overall financial health and net worth by looking at its assets, liabilities, and equity at a specific point in time.

When making a balance sheet, it’s important to make sure that your assets balance with your liabilities and equities. Drawing on journal entries ensures that this process is as accurate as possible.

When looking at a balance sheet, there are various ratios that reflect certain aspects of the company. The quick, current, and debt/equity ratios provide a quick picture of the company’s current position.