Zetl launches Wage Layer enabling SMEs to manage payroll in minutes

Zetl’s innovative solution helps SMEs alleviate month-end payroll angst

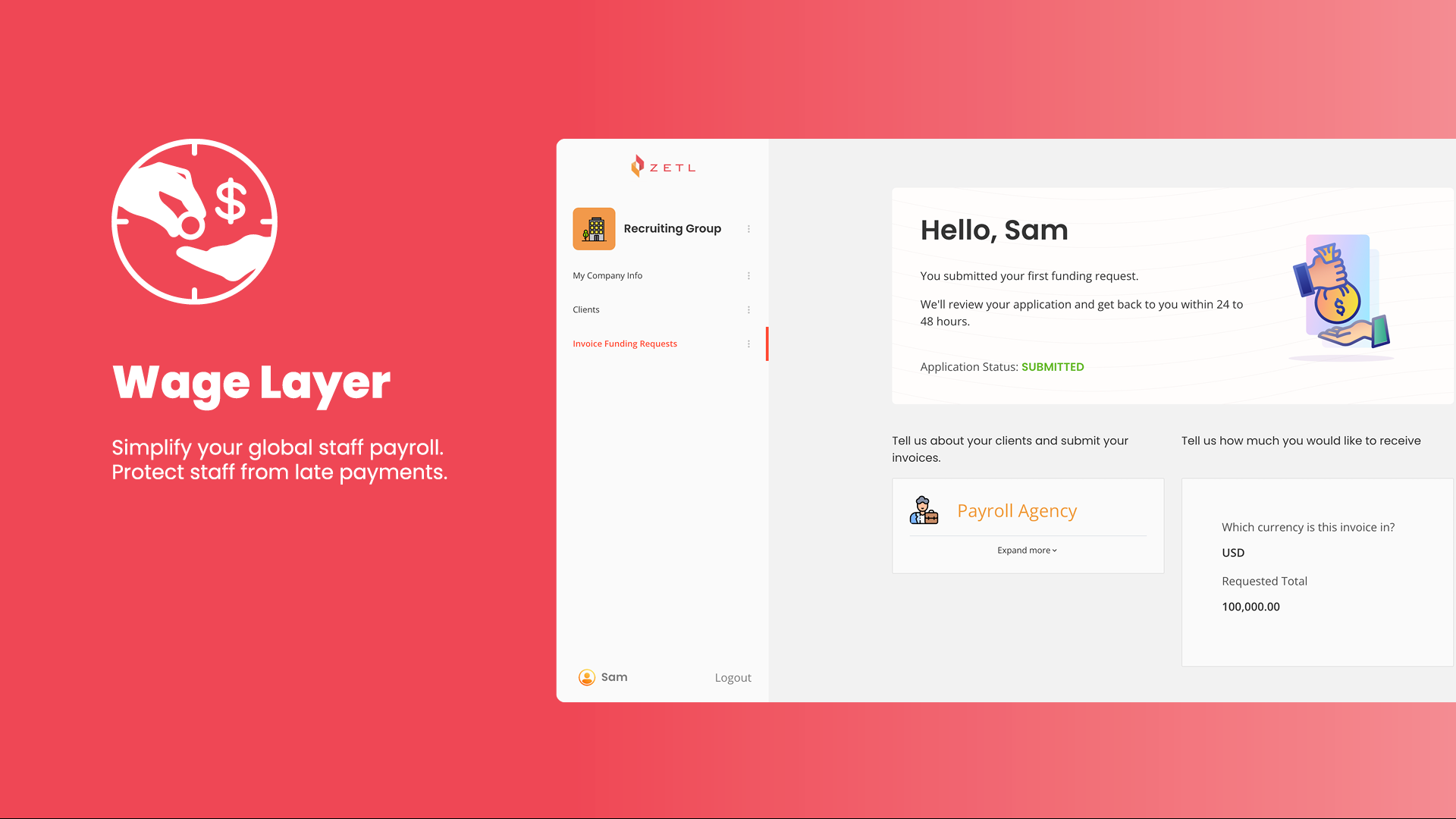

Hong Kong, October 12th, 2021 - Zetl, the fast-growing fintech startup based in Hong Kong and Singapore, announced today it is simplifying the global payroll process with the launch of Wage Layer, available for businesses across Asia-Pacific. Wage Layer allows SMEs to protect their staff from late payments and simplifies their payroll process. Zetl is Asia’s first financing company tailor-made for asset-light businesses.

Wage Layer allows businesses to make one single payroll payment, while Zetl takes care of the rest. Companies can streamline their admin and significantly reduce their effort and time for payroll. Zetl charges only 1.5% of the total payroll inclusive of foreign exchange and wire fees.

“We launched Wage Layer because we’ve all experienced the same month-end stress many entrepreneurs face–ensuring enough cash is on hand to make payroll, especially in a fast-growing business. Wage Layer acts as an insurance policy, ensuring you’ll never miss payroll while also taking away the administrative burden of payroll at the same time,” says Shan Han, CEO and Co-founder of Zetl.

Wage Layer also enables businesses to defer their payroll bill by pausing payments on demand. Zetl continues to process payroll for the month, allowing companies to benefit from better cash flow. In turn, employees have the safety and security of being paid on time every month. This function is new to the Hong Kong market and starts at 1.5% per month of the deferred amount.

“The age of complicated financing is over. The slow adoption of technology by traditional banks and financial institutions has left a big gap in the market. This has caused many SMEs to suffer financially. We are on a mission to change this dramatically. Businesses deserve the chance to grow with transparent and flexible financing.” says Han.

With work from home becoming the norm and companies hiring their employees in different countries, payroll has become a significant burden to SME owners. In APAC, 45% of business owners still manually enter their payroll data taking up 2 to 5 days per month. According to a Deloitte survey conducted in 2020, technology limitations were the biggest challenge by far.

Wage Layer is simple to set up and requires no upfront fees or deposits. This ethos is in line with Zetl’s aim to make financing simple and transparent. All of their products require no personal guarantees, are fully digital, and are confidential. Customers can sign up through the Zetl website in minutes and receive funding within 24 hours.

Apart from Wage Layer, Zetl is set to launch more banking and payroll products to businesses that are asset-light in nature. These businesses often don’t have equipment, inventory, or property which they can use for financing. They often also don’t have a multi-year operating history. Companies like this are ideally placed to utilise Zetl to finance its operations by unlocking working capital from its accounts.

FOR IMMEDIATE RELEASE: contact: Sam Hodgett, [email protected]

------ END RELEASE -----

Notes to Editor:

About Zetl

Zetl is Asia-Pacific’s first financing company for asset-light businesses. They help staffing agencies, consultancies, and other services businesses manage their monthly operating expenses by providing working capital, payroll and growth financing. Zetl is headquartered in Hong Kong and offers its solutions through Asia-Pacific.