How to manage your working capital — the essential guide

Working capital, also known as net working capital or WC, is a key financial metric for any type of business. It measures how much cash you have to run your day-to-day activities for the next 12 months.

What is working capital? How do you manage it? And do you need more of it?

In this post, we’re diving deep into the working capital concept with plenty of examples to help you focus on growing your business.

What you will find:

- What is working capital?

- Working capital formula

- Other financial calculations to measure working capital

- What is the working capital cycle?

- How is working capital managed?

- What is a working capital loan?

- How Zetl can help you with your working capital

- Conclusion

WHAT IS WORKING CAPITAL

Working capital, also known as net working capital or WC, is a key financial metric for any type of business. It measures how much cash you have to run your day-to-day activities for the next 12 months.

It also reflects many company activities, like inventory management, revenue collection and payment to suppliers.

Working capital is the difference between a company’s current assets and current liabilities on the balance sheet.

Current assets are the assets that can be converted to cash within 12 months. These can include:

· Cash and cash equivalents

· Accounts receivable

· Stock inventory

· Prepaid expenses

Current liabilities are debts or financial obligations that need to be paid within a year. These typically include:

· Accounts payable

· Accrued payroll

· Short term / current debt

While working capital is closely related to a company’s liquidity, it’s not quite the same.

Working capital helps measure liquidity. Liquidity specifically refers to how easily a company can pay off its debts and expenses within a year when the assets are sold.

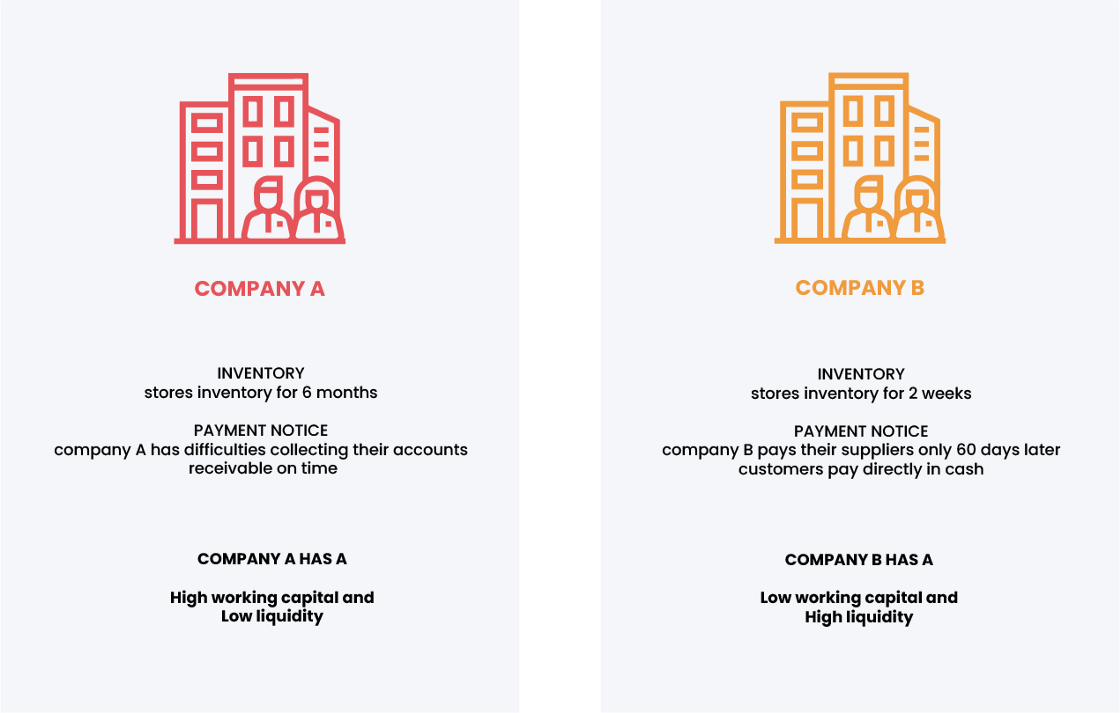

To illustrate this difference, we’re looking at two fictitious companies below:

From the two examples above, we can see that working capital needs to be analysed in the context of a company’s operational activities.

Working capital is used in every business because it indicates financial strength. Investors use it to evaluate a company’s performance; business owners use it to determine whether they need to raise capital or go into debt within the next 12 months.

That said, when a company has too much working capital, it can also mean that their assets are not being efficiently invested to allow for a company’s growth.

HOW IS THE FORMULA CALCULATED?

The working capital formula is:

Working Capital = Current Assets — Current Liabilities

To express working capital as a ratio, also known as the current ratio, you can use the following equation:

Current Ratio = Current Assets / Current Liabilities

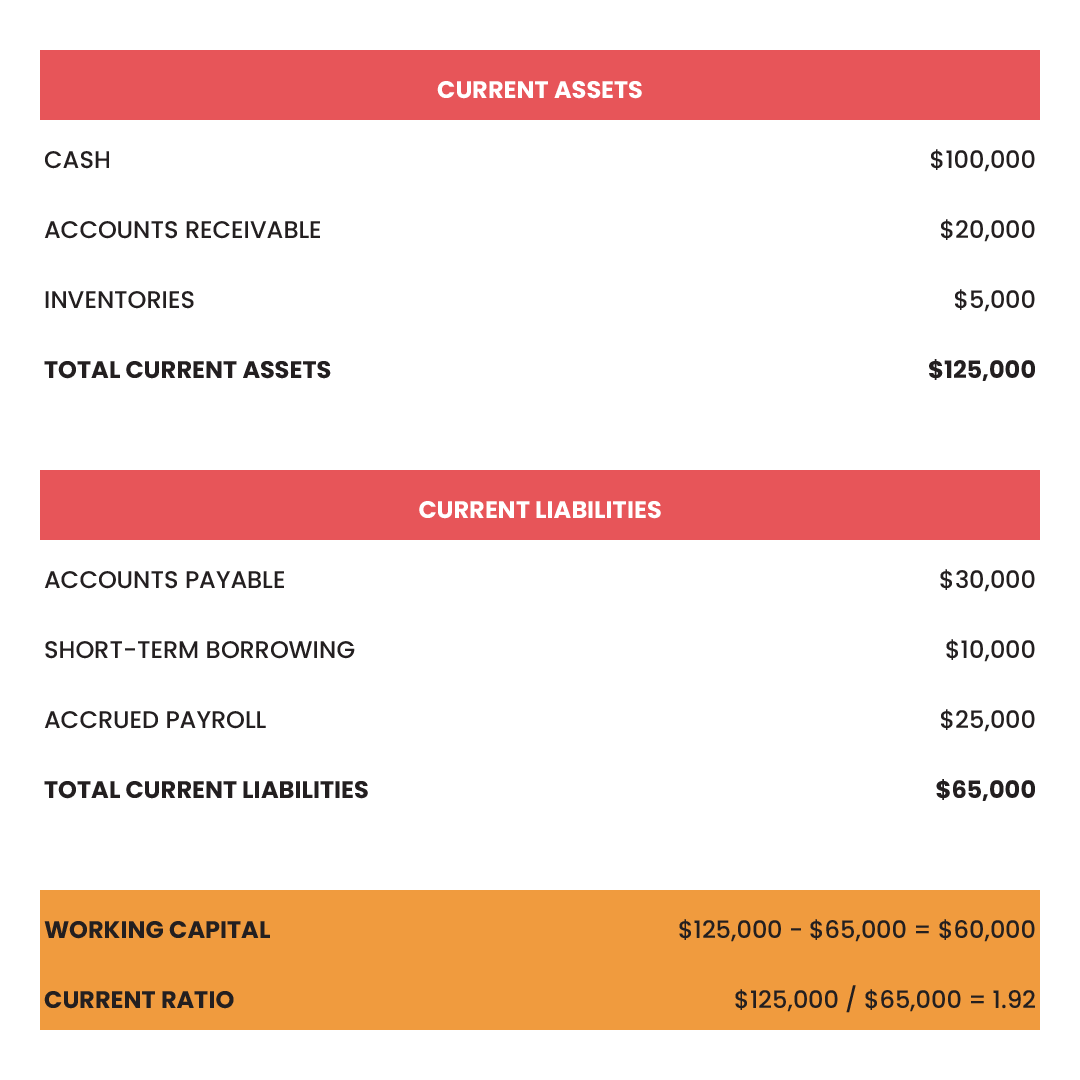

Here’s a snapshot of a balance sheet from the fictitious company X.

In the above balance sheet, company X has a current ratio of 1.92. It indicates that the company has roughly 2 times the amount of cash it needs to pay off its debts and pay for their operational activities. This is a sign of a healthy company to investors.

If a company has a current ratio that’s less than 1, it shows investors that the company can’t pay off its debts within a year. This indicates that the company needs to either raise capital or go into debt.

When a company has negative working capital, they will probably face liquidity and potentially bankruptcy problems.

OTHER FINANCIAL CALCULATIONS TO MEASURE WORKING CAPITAL

Below you can find some useful calculation when you are measuring your company’s working capital.

WORKING CAPITAL DAYS

You can also assess your working capital by looking at the number of days. Working Capital Days refers to the number of days it takes for a company to turn its working capital into sales revenue. Ideally, the lower the number the better. This can be done through the following formula:

Days Working Capital = (Working Capital * 365) / Revenue from Sales

For example,

Joe has a book store and in 2020 he sells $150,000 worth of books. In the same period, his working capital was $1000.

= (1000*365)/150000 = 2.43

From the above example, you can see that Joe’s working capital days is 2.43. This means that it takes him roughly 2 to 3 days to turn his working capital into revenue.

INVENTORY TURNOVER RATIO

Inventory turnover refers to the speed at which you sell your inventory at. The higher the number, the faster your inventory sells; the lower the number, the longer you keep your inventory. A high turnover ratio is an overall indication of an efficient company. This ratio is particularly useful when compared with the industry average as it’s an indication of sales and inventory management.

It is calculated using the following formula

Inventory turnover rate = cost of goods sold / average inventory

For example,

Ana buys $200,000 worth of earrings in 2020 to sell to her customers. Her beginning inventory was 100,000 and her ending inventory is 15,000.

Ana’s cost of goods sold is $200,000

Ana’s average inventory is (100,000 + 15,000) / 2 = 57,500

Ana’s inventory turnover ratio is:

200,000 / 57,500 = 3.48

This means that in 2020, Ana took around 3 days to sell her inventory.

ACCOUNTS RECEIVABLE(AR) TURNOVER RATIO

AR turnover ratio measures how efficiently the company is getting paid. This is important to assess how quickly cash is coming into the business and is measured using the following formula:

Accounts receivable turnover ratio: Net credit sales / average accounts receivable

For example,

Eric owns a recruitment company. He makes money by placing candidates in a company, but only gets paid after the candidate successfully passes the probation period.

In 2020, Eric earns $1,500,000 in revenue. His accounts receivable in the beginning of the year is $267,000 and at the end of the year is $133,000.

Eric’s AR turnover ratio is

= 1,500,000 / ((267,000+133,000)/2) = 7.5

This means that Eric’s cleared his accounts receivable 7.5 times in 2020. It took him on average 49 days (365/7.5=48.6) to clear his AR.

DAYS PAYABLE OUTSTANDING (DPO)

DPO is a financial metric which assesses how many days it takes for a company to pay their bills to their suppliers. This can be a valuable metric because it shows how cash is being managed. The DPO formula is

(Average accounts payable / Cost of goods sold) x number of days in accounting period

For example,

Rory has a recruitment firm and uses Linkedin Recruiter to find, manage and engage with her candidates. Rory has an agreement with Linkedin to only pay the invoice after 90 days. The cost of sales for her in 2020 was $100,000. Her average accounts payable was $20,000.

Rory’s DPO is (20,000/100,000)*365 = 73

This means that it takes Rory about 73 days before she is able to pay her suppliers.

QUICK RATIO (ACID-TEST RATIO)

The quick ratio is used to measure whether the company has enough cash to pay off its debts. This is different from the current ratio because it doesn’t include harder to liquidate assets like inventory. Therefore, this metric is arguably a more accurate ratio to measure a company’s liquidity. It is calculated using the following formula:

Quick ratio = (Cash and cash equivalents + marketable securities + accounts receivable) / current liabilities

For example,

When we take a look back at the fictitious company X, their current ratio is 1.92. We will use the same balance sheet to measure their quick ratio.

(100,000+20,000) / 65,000 = 1.84

This means that company X is still a very liquid company.

The following formulas don’t mean much without comparison.

Ideally you will benchmark your numbers to your previous year and industry statistics. You can find more industry benchmarks and statistics on these financial metrics using the PWC Working Capital Report or Stern’s Working Capital Ratios by Sector Report.

WHAT IS THE WORKING CAPITAL CYCLE?

The working capital cycle is also known as the cash operating cycle. It looks at the number of days and processes to turn your inventory into cash. It does this by looking at the inventory days, receivables days and payable days. The WC cycle formula is

Working capital cycle = Inventory Days + Receivable Days — Payable Days

Inventory days, or days in inventory refers to the number of days the stock is held in inventory before it is sold.

Inventory Days = (Average inventory / cost of goods sold) * 365

Receivable days refers to the number of days it takes before debt owed to you is collected.

Receivable Days = (Accounts receivable / revenue) *365

Payable days refers to the number of days it takes before you have paid your debtors.

Payable Days = (Accounts payable / revenue) *365

As evident from the formula, the working capital cycle consists of

- Paying for your inventory (accounts payable days)

- Selling your inventory (inventory days)

- Receiving payment from your inventory (accounts receivable days)

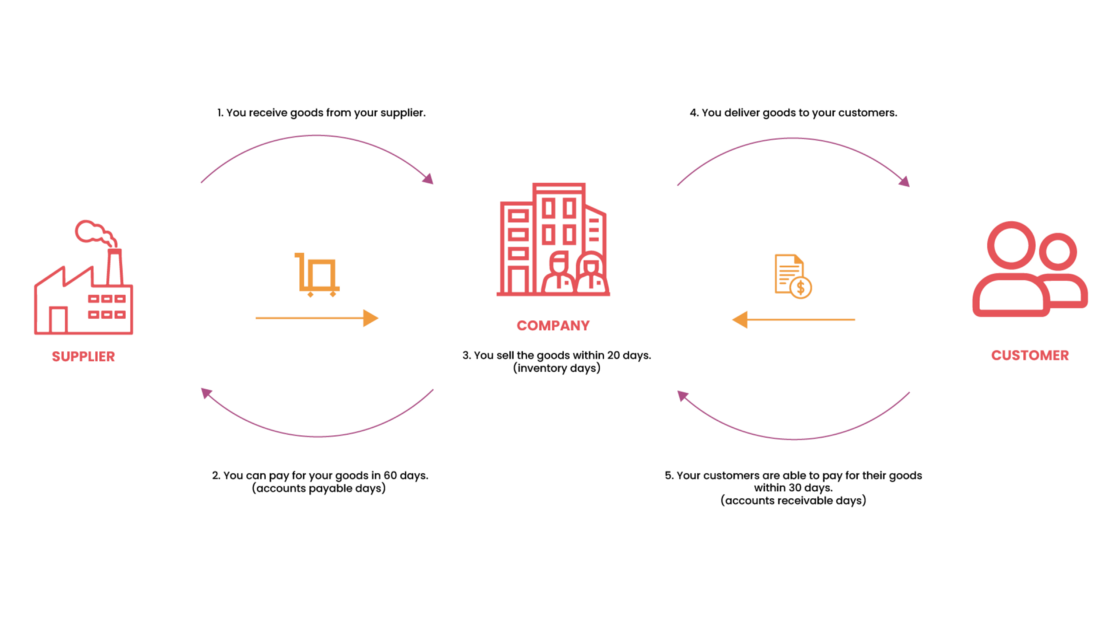

Let’s take a look at the following example.

The following fictitious company has

- 20 inventory days;

- 30 receivable days; and

- 60 payable days

Their working capital cycle is 20+30–60 = -10. This means that the company has an efficient working capital cycle because they don’t have any cash flow issues. If the number was positive, it means that the company needs to pay out of pocket before receiving the full customer’s payment.

HOW IS WORKING CAPITAL MANAGED?

Working capital is managed by analysing factors such as cash, inventory and accounts receivable, supplier payments and employee costs. Here are 5 essential tips to managing your working capital:

IDENTIFY YOUR OPTIMUM STOCK LEVEL

If you’re an asset-based business, you’d know how difficult it is to manage your inventory. Too much stock can cause your cash to be tied up for too long, whereas too little stock can cause problems with your customers. Despite the difficulties, try to analyse your business so that you can buy your stock just in time and determine your optimum stock level.

AUTOMATE YOUR ACCOUNTS RECEIVABLE PROCESS

Chasing your overdue bills can be a time-consuming task. If you’re able to automate the process through an accounting software like xero, it can save you plenty of time. It also allows you to get a detailed overview of your finances.

KEEP YOUR TEAM INVOLVED

As a business owner or manager it can be difficult to keep your team aligned, however when you make sure the team understands what you are optimising for they can make their decisions based around that. This can be done through determining the KPI’s you want to focus on per quarter.

MANAGE YOUR EXPENSES

Small expenses can easily creep up when not managed and looked at regularly. By keeping track of your expenses and understanding the difference between the essential and nice to have expenses, you have already started managing your working capital.

ALTERNATIVE LENDING

In the event that your working capital is low due to your accounts receivable, you can look for alternative lending solutions like a working capital loan or invoice discounting companies. This can help your business to continue growing while being flexible to your customers.

WHAT IS A WORKING CAPITAL LOAN?

If working capital is the money you have for your day-to-day activities, then a working capital loan is a loan you receive for these types of activities. These loans are extended for factors like rent, inventory, payroll and debt.

A regular loan, for example your mortgage, is secured against collateral. This means that if you aren’t able to pay, the bank is able to take over the house. Working capital loans are typically not secured against any collateral.

HOW ZETL CAN HELP WITH YOUR WORKING CAPITAL?

At Zetl, we help SMEs with their cash flow by providing invoice financing and working capital loans. Our mission is to finance the next generation of businesses in APAC. We work to make sure you can grow your business without having to worry about your accounts receivables (AR).

Our working capital loans are secured by your AR. This means that we extend loans up to 90% of your AR amount. This can help you free up the cash you need to expand your business, pay your staff and remain competitive within the marketplace.

Here are a few reasons why our customers love us:

- You can receive up to 90% of your invoice within hours

- No personal guarantees

- Fast customer service team

- 100% digital

- No hidden fees

If you would like to have a chat about how we can help your business grow, feel free to email us at any time at [email protected].

Alternatively, sign up to our monthly newsletter to receive the latest trends and news on working capital and finance in the Asia-Pacific region.

CONCLUSION

Working capital is a financial metric that measures the liquidity of a company. It does this by looking at the difference between your current assets and current liabilities. Working capital should be looked at in relation to other financial metrics, such as the current ratio, working capital cycle and inventory turnover ratio.

Working capital can be managed by finding your optimal stock levels, automating the account process and alternative lending solutions.

At Zetl, we’re here to help you with your working capital needs by providing you with loans collateralised against your accounts receivables.

If you’re interested to see how much you can receive, sign up here.