What you need to know about trade finance

Trade finance is an umbrella term that deals with financial products and services. Banks and financial institutions offer these allowing businesses to trade internationally.

According to the WTO, 80 to 90% of the world trade relies on trade finance. But how does it exactly work?

This article will give you the insight on what trade finance is and how it can benefit your business.

What is trade finance?

Trade finance is an umbrella term that deals with financial products and services. Banks and financial institutions offer these allowing businesses to trade internationally.

The main reason for such financial products is to reduce the buyer and seller’s risk. It can be best explained using the example below.

A clothing company in Canada wants to buy 10,000 different types of textiles from India. The Indian seller does not want to ship the products before getting paid in the event that the buyer doesn’t pay. The Canadian clothing company doesn’t want to pay in advance. This is because they bear the risk that the seller doesn’t ship the products.

Trade finance allows these transactions to happen. The banks back the companies because they use trade finance products.

Trade finance is hard to define because it’s very broad. One could argue that trade finance is simply:

“An umbrella term for financing international trade”

How trade finance works

Trade finance works by bringing in financial institutions or banks to a trade. They back the companies that are importing and exporting their goods and services.

Let’s take a look back at the example of the Canadian clothing company from before. The way these two firms can move forward is to use trade finance products. This means that the banks who have backed these companies will come into the picture.

When the banks are brought in, it reduces the payment and shipping risk for the buyer and seller.

Why is trade finance important?

Trade finance has become incredibly significant as globalisation and international trade has increased. According to the WTO,“80 to 90% of the world trade relies on trade finance (trade credit and insurance/guarantees), mostly of a short-term nature.”

Besides the significance and non-payment risk, trade finance helps to protect companies in other ways. The products include protection against the creditworthiness of parties, foreign exchange rates, and the political climate.

What are trade finance products?

Banks and other financial institutions offer several trade finance services. Some of the most common solutions are found below.

1. Export Trade Financing

These range of products help suppliers make sure they are able to fulfil their orders. The products that fall under this category can include a letter of credit, packaged loans and forfeiting.

2. Import Trade Financing

Import financing, on the other hand, assists buyers. They finance the difference between sending the payment and receiving their goods. Some products can include shipping guarantees, letter of credit issuance, and import collection financing.

3. Accounts Receivable Financing

AR financing allows sellers to provide flexible payment terms without cash flow problems. This can be done through products such as financing backed by A/R and factoring A/R.

Methods of payment in trade finance

Trade finance uses various payment methods to protect the buyers and sellers. These are a letter of credit, advance payment, bill for collection and open account.

Letter of credit

Letters of credit is a document between the seller’s bank and the buyer’s bank. It’s a financial instrument that guarantees the buyer’s bank to pay the seller’s bank. This is only agreed upon if the goods shipped are exactly according to the documented requirements.

Essentially, a letter of credit is a promise to pay. This is beneficial for the buyer as it avoids the risk of the goods not arriving. Another benefit is receiving the goods according to the exact specifications of the buyer. The seller also benefits as the trust is within the buyer’s bank as opposed to only the buyer.

This form of payment is used between parties that have no trust build between them yet. While it is typically used for international trade, it can also be used for domestic trade.

Advance Payment

In smaller transactions, the seller will typically offer a different payment term. The seller will need 30 to 50% of the invoice upfront. The remaining amount is required once the goods are exported.

Bill for Collection

A bill for collection is a set of documents whereby the buyer agrees to pay a fixed amount at a certain date. This is different from a letter of credit because it can be used by the seller to sell to the bank at a discounted rate. This is typically used when there is already trust established between the two parties.

Open Account

When the buyer and seller have known each other for a while, they have built trust and a strong relationship. This can be advantageous for the buyer as they can negotiate various payment terms. This is usually whereby the buyer agrees to pay the seller after 30, 60 or 90 days after the goods have been exported.

While this is a huge advantage for the buyer, the seller might find itself in cash flow problems. For this reason, the seller will often take out insurance and a working capital loan.

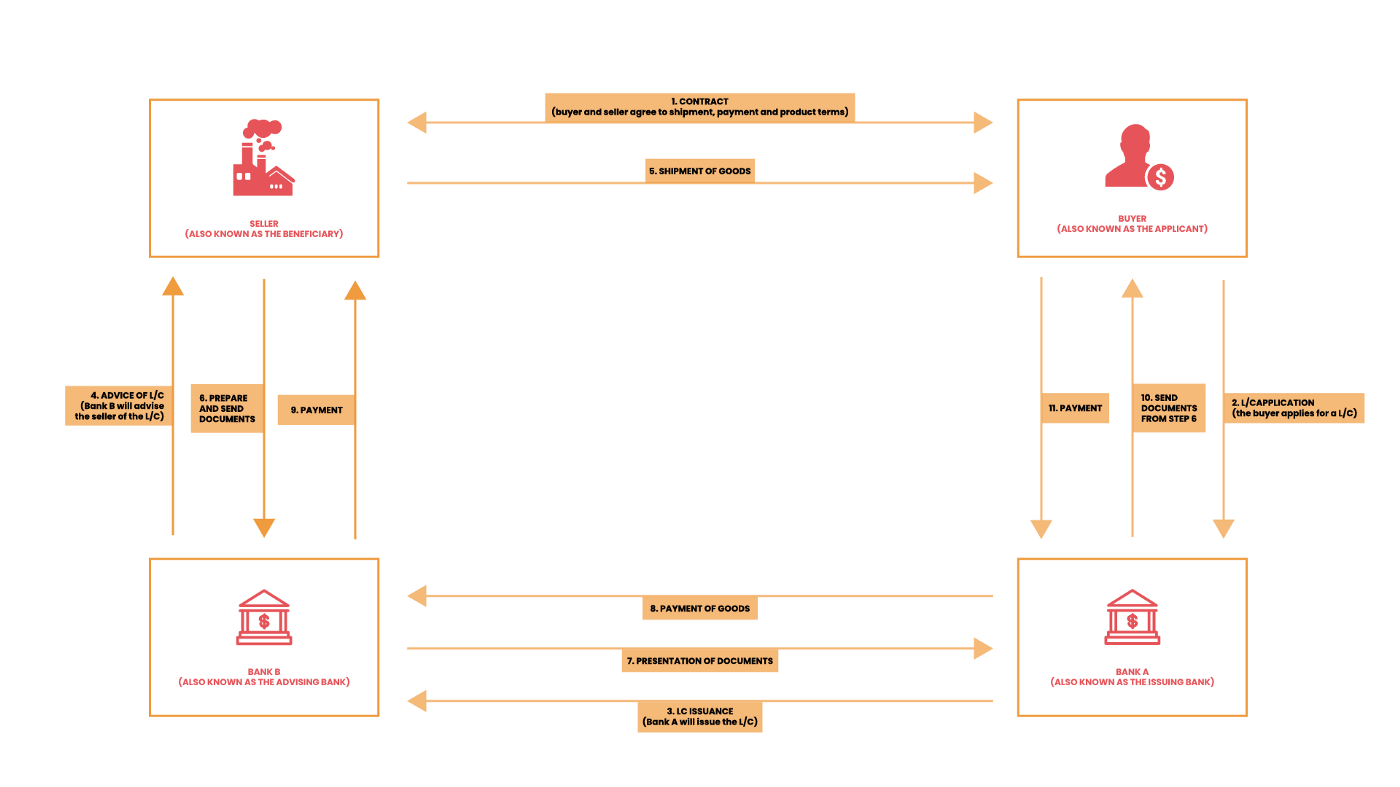

Trade Finance Process Flow: An example of how trade finance works

In the following example we have listed out the trade finance procedure that is commonly found using the letter of credit method.

- Contract: The buyer and seller have agreed to have is being sold, how it will be paid and shipped

- L/C application: The buyer will apply for a letter of credit to their bank

- L/C Issuance: Bank A will issue the letter of credit to bank B

- Advice of L/C: Bank B will advise their client (the seller) of the letter of credit

- Shipment of goods: The goods will be shipped to the buyer

- Prepare and send documents: The seller will prepare documents like the bill of lading

- Presentation of documents: Bank B will present these documents to bank A

- Payment of goods: Upon receiving these documents and assuming that the requirements are met, Bank A will pay Bank B

- Payment: Bank B will pay the seller

- Send documents: Bank A will present the documents to the buyer

- Payment: The buyer will pay Bank A for the goods

Conclusion

We’ve rounded up the basics of trade finance. It’s a broad term which includes financial products offered by banks that allow businesses to trade internationally.

According to the WHO, 80–90% of the world trade is dependent on trade finance. This is because trade finance allows for access to capital. This is especially true in industries where high capital costs are the norm.

There are several trade finance products. The most common ones are export trade, import trade and accounts receivable financing.

Businesses can use several payment methods. These include a letter of credit or advance payment. Companies can also use a bill for collection or open account when dealing with trade finance.